The Keller Home Selling Team is constantly assessing the market on behalf of our client's and followers. While the housing market has risen dramatically since the beginning of the year, this article written by a trusted nationwide blog source " Keeping Current Matters", says NO BUBBLE to worry about. We believe this article to be true based on our local market knowledge and analysis.

While we can't predict exactly what the market will do, our jobs are to interpret the market as best we can. We still believe it is a great time to buy and encourage anyone thinking about buying to do it now. We believe in the end, you'll be glad you did. If you have a house to sell, take advantage of the recent gains and call us for a free price opinion.

As always, we're available to consult to you anytime you have questions.

----------------

The housing market is recovering so nicely that it has caused some to wonder whether a new housing bubble is forming. Today, we want to explain that the fear of a new pricing bubble in real estate is unwarranted.

Trulia revealed some great data on this point in a recent blog post. They explained that, even with the recent price increases, national home prices are still 7 percent undervalued. Trulia explained:

“Home prices nationally remain undervalued relative to fundamentals and much lower than in the last bubble. That’s why today’s price gains are actually still a rebound, not a bubble.”

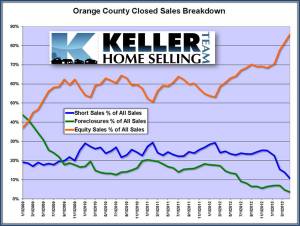

Prices are below their fundamental value in the vast majority of the country (91 of the 100 largest metros). Even in the parts of the country that are now overvalued they come nowhere near the percentages we saw in 2006-2007. For example, let’s look at the two markets that are most overvalued today. In Orange County, California prices are currently overvalued by 9%. In 2006, prices in the region were overvalued by 71%! The second most overvalued market today is Austin, Texas at 5%. Texas real estate prices did not skyrocket as they did in many other parts of the country during the last boom. Austin prices were shown as being 12% overvalued at the time.

Again, prices are still undervalued in 91% of markets and, even in the markets that are overvalued, they are nowhere near the numbers of the 2006-2007 bubble.

Jed Kolko, Trulia’s Chief Economist, explained:

“So are we in bubble territory? No. Bubble-phobes can rest easy. Even with recent sharp home price increases, prices are still low relative to fundamentals and are far below bubble levels.”

Dr. David Stiff, chief economist for CoreLogic Case-Shiller agreed in a recently releasedreport on prices:

“Even if double-digit price appreciation were to continue in former bubble metro areas, there is no reason to believe that new home price bubbles are forming. That’s because single-family homes in these markets are still very affordable, even after last year’s large price gains.”

Three reasons there will NOT be another bubble

Prices are determined by the ratio between supply and demand. Here are three reasons a bubble will be avoided.

- Supply is beginning to increase. A lack of inventory is creating a market of multiple bids which has caused prices to rise. The National Association of Realtors (NAR), in their latest Existing Home Sales Report, revealed that the months’ supply of inventory has increased from 4.3 to 5.2 months since January.

- Demand will decrease in certain demographics. For an example, investors have been a large part of the housing market over the last several years. As prices continue to rise, a certain percentage of these buyers will back off.

- As mortgage rates increase, buyers will be able to afford less. The Mortgage Bankers Association, Fannie Mae and NAR have all projected an increase in mortgage rates over the next year. Buying power will decrease as borrowers can no longer afford the same price point as monthly payments will increase.

For these reasons, we believe the fear of a new housing bubble are currently unfounded.